If you are here, we presume that you are already taking advantage of a Section 423 qualified ESPP your company offers. Following are a few key terms:

- Offering Period

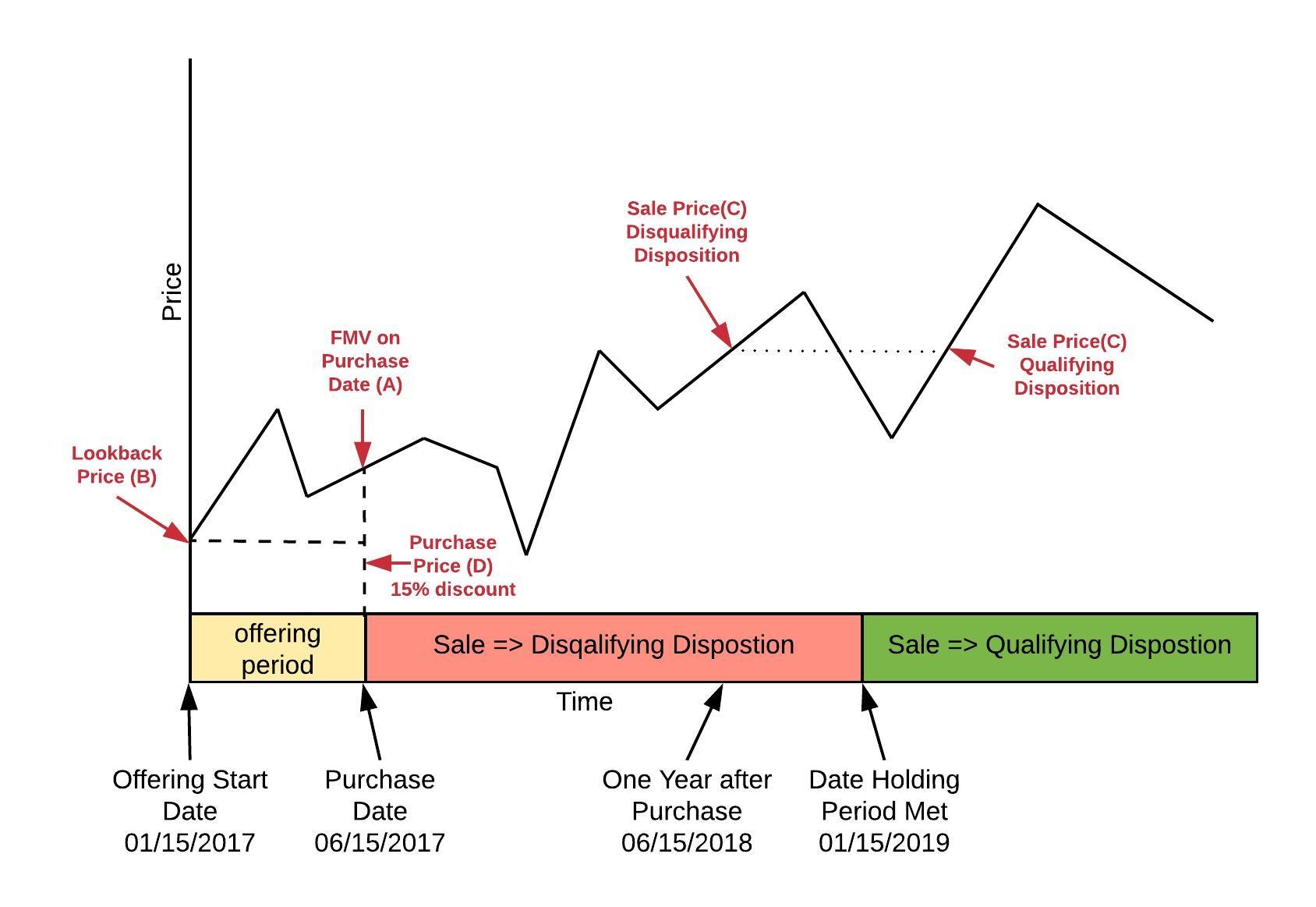

- The offering period is a predetermined length of time during which after-tax contributions are collected via a payroll deduction.

- Purchase Date or Exercise Date

- Date on which stock is purchased using your payroll contributions that were accumulated during the offering period.

- FMV on Purchase Date or Exercise Date

- FMV is an acronym for 'Fair Market Value'. FMV on purchase date is the price of the stock on the purchase date at the end of the trading day on the public stock exchange it is listed on.

- Lookback Provision

- Usually the ESPP terms indicate that your purchase price on the purchase date is determined by discounting the lower value among (A) the FMV on purchase date and (B) FMV on the first day of the offering period. This provision is called the lookback provision.

Example ESPP Scenario

- Beginning of the Offering Period (Lookback Date)

- 15th Jan 2017

- First Purchase Date during the Offering Period

- 15th Jun 2017

- Fair market value on Purchase Date or Exercise Date (A)

- $117

- Fair market value on First Day of Offering Period or Grant Date (B)

- $100

- Fair market value on Date of Sale or Date of Disposition (C)

- $120

- Purchase Price(D)

85/100 x lower-of(A,B)

-

$85

- Total Paycheck Deductions during Offering Period(E)

- $15000

- Number of Stock Purchased(F)

Total Paycheck Deductions during Offering Period(D) / Purchase Price (C)

-

176.47

All ESPP stocks sold before the end of the holding period, as considered disqualified disposition.

Here's an example of how tax is calculated for a disqualifying disposition:

- Ordinary Income (Discount)

( FMV on Purchase Date(A) - Purchase Price(D) ) x Number of Stock Purchased (F)

- ($117 - $85) x 176.47

- Short Term Capital Gains

$0 if (Sale Price(C) - FMV on Purchase Date(A)) < 0 ;

Otherwise (Sale Price(C) - FMV on Purchase Date(A)) x Number of Stock Purchased (F)

- ($120 - $117) x 176.48

- Ordinary Income Tax

(Ordinary Income Tax Rate / 100) x Ordinary Income

- (24/100) x $5647.06

- Short Term Capital Gains Tax

(Ordinary Income Tax Rate / 100) x Short Term Capital Gains

- (24/100) x $529.41

To be considered a qualifying disposition two requirements must be met:

- Ordinary Income (Discount)

LowerOf( FMV on Date of Sale(C) - Purchase Price(D), FMV on First Day of Offering Period or Grant Date (B) - Purchase Price(D)) x Number of Stock Purchased (F)

- LowerOf($120 - $85,$100 - $85) x 176.47

- Cost Basis

IF(FMV on Purchase Date(A) - Purchase Price(D)) < (Fair market value on First Day of Offering Period(B)) - Purchase Price(D))

THEN CostBasis = A

ELSE CostBasis = B

- $100

- Long Term Capital Gains

$0 if (Sale Price(C) - Cost Basis) < 0 ;

Otherwise (Sale Price(C) - Cost Basis) x Number of Stock Purchased (F)

- ($120 - $100) x 176.47

- Ordinary Income Tax

(Ordinary Income Tax Rate / 100) x Ordinary Income

- (24/100) x $2647.06

- Long Term Capital Gains Tax

(Long Term Capital Gains Tax Rate / 100) x Long Term Capital Gains

- (15/100) x $3529.41